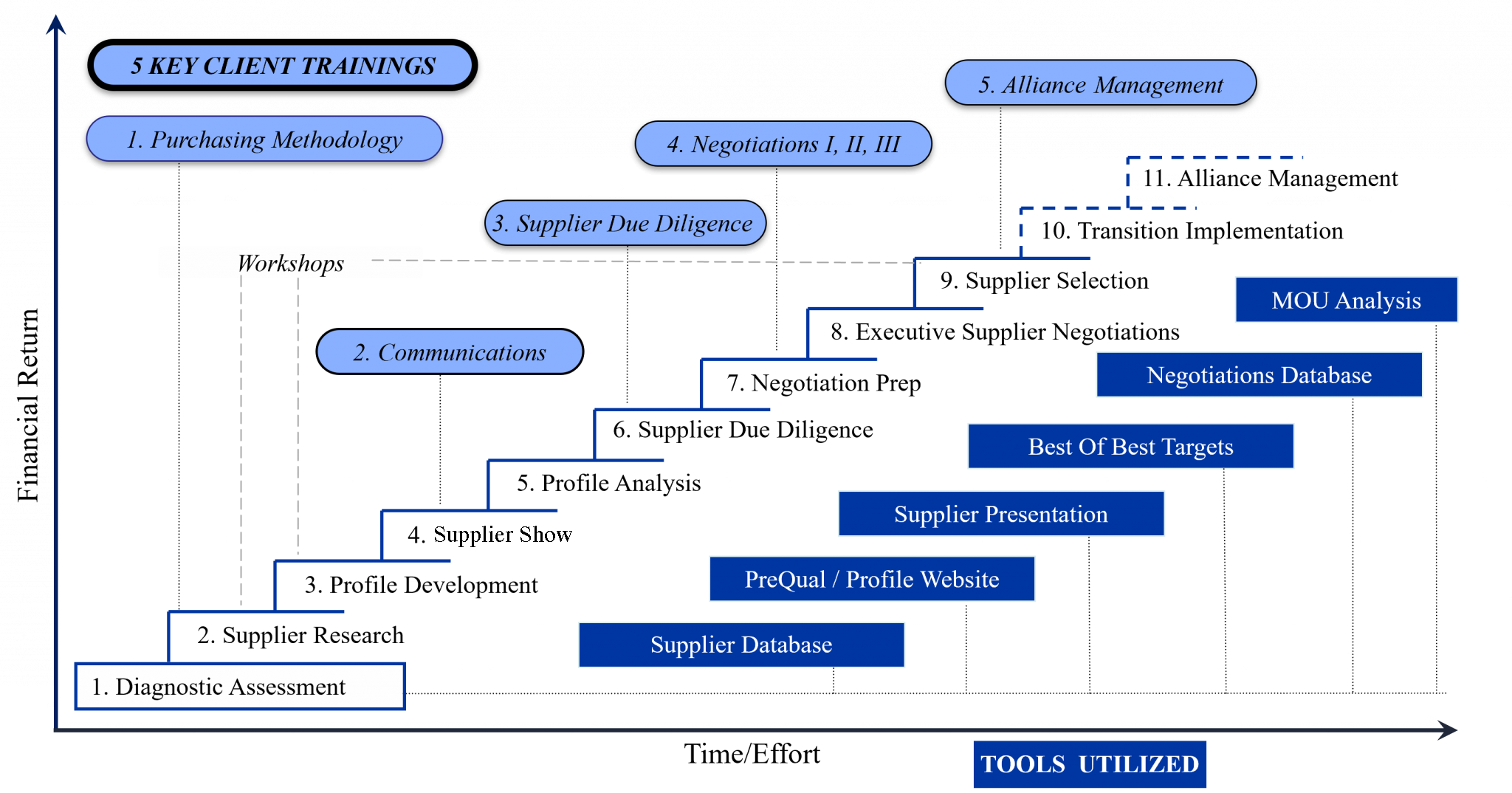

Our 11-Gate Process

From our initial high-level assessment, to aligning on strategy, on through to execution, Gibson is with you every step of the way. We measure success in actual dollars saved along with our clients’ satisfaction, and we believe our Consulting Services are the path to our clients’ prosperity.

Step 1: Opportunity Assessment

Client teams begin the process by gathering spend data, interviewing cross-functional personnel, and evaluating existing skill sets in order to properly assess the benefits to be achieved. The intelligence gathering allows not only Gibson, but also our clients, to appraise, manage and prioritize savings, training and other business opportunities.

Step 2: Supplier Research

Our team researches the global marketplace for suppliers that fit our client’s specific needs. This crucial step allows for customized benchmarking, differentiation and increased negotiation outcomes by introducing new and reengaging current suppliers.

Step 3: Profile Development

Clients develop RFQ and RFI profiles which solicit the specific information needed for the cross-functional client team to make data-driven decisions on a supplier’s ability to be a viable longterm supplier. This is the initial phase of data collection from suppliers, which provides market intelligence on the category and is leveraged to determine best practices.

Key Activities: Internal Site Visits-Detailed Category Analysis | RFQ Development | RFI Development

Step 4: Supplier Show

Client executives and stakeholders come together to build excitement and to announce their strategic sourcing project to the top executives of all potential suppliers, engaging friendly competition and education between companies.

Step 5: Profile Analysis

Clients evaluate completed profiles in an “apples-to-apples” comparison in order to narrow down the list of potential suppliers, educate themselves on the marketplace, and build customized minimum targets for negotiations.

Step 6: Site Visits

Price is important, but don’t forget about quality. Clients visit plants of selected new and incumbent suppliers, engaging in extensive tours and face-to-face discussions in order to verify profile responses, qualify capabilities, build relationships, and substantially increase their overall market knowledge.

Step 7: Negotiations Preparations

Over the course of multiple weeks of training and workshops, client teams prepare for negotiations. The market intelligence collected from supplier profiles and site visit sets “best of the best” targets for various topics which will be discussed during negotiations.

Step 8: Negotiations

Client executives come together with supplier’s top management to negotiate over thirty separate issues and discover each supplier’s ability to meet all the team’s goals. These negotiable issues are documented in a Memorandum of Understanding which captures the terms under which business would be conducted.

Step 9: Supplier Selection

Client teams, taking into account all information collected throughout the process, select the suppliers that offer the “lowest total cost” and best overall value for the goods or services being sourced.

Step 10: Transition Implementation

To ensure successful project completion, Gibson remains an active participant as client teams move through the initial phases of contract execution and co-develop implementation plans with their selected alliance partners. Written communications, conference calls, webinars and/or live forums are scheduled to notify all internal stakeholders of the program.

Key Activities: Closing Meetings | Award of Business | Planning & Tracking | Internal Communication to Facilities & Stakeholders | External Communication to Alliance Supplier Sites & Personnel | Alliance Supplier Forums & Kick-Offs | Phase-Out of Unsuccessful Incumbents | Phase-In of New Suppliers (Commercial & Technical)

Step 11: Alliance Management

Gibson will put in motion the tools, resources, reporting and support to ensure future and continued support and information sharing will occur throughout the relationship. Areas of focus that fall within this area are value engineering teams, new product development teams, cost reduction teams, product rationalization teams, inventory optimization teams, and quality improvement teams.

Key Activities: Meetings & KPIs | Savings Tracking | Acceleration of Savings | SKU Rationalization | VAVE (Value Analysis & Value Engineering) | New Product Development